Welcome to traderwise.

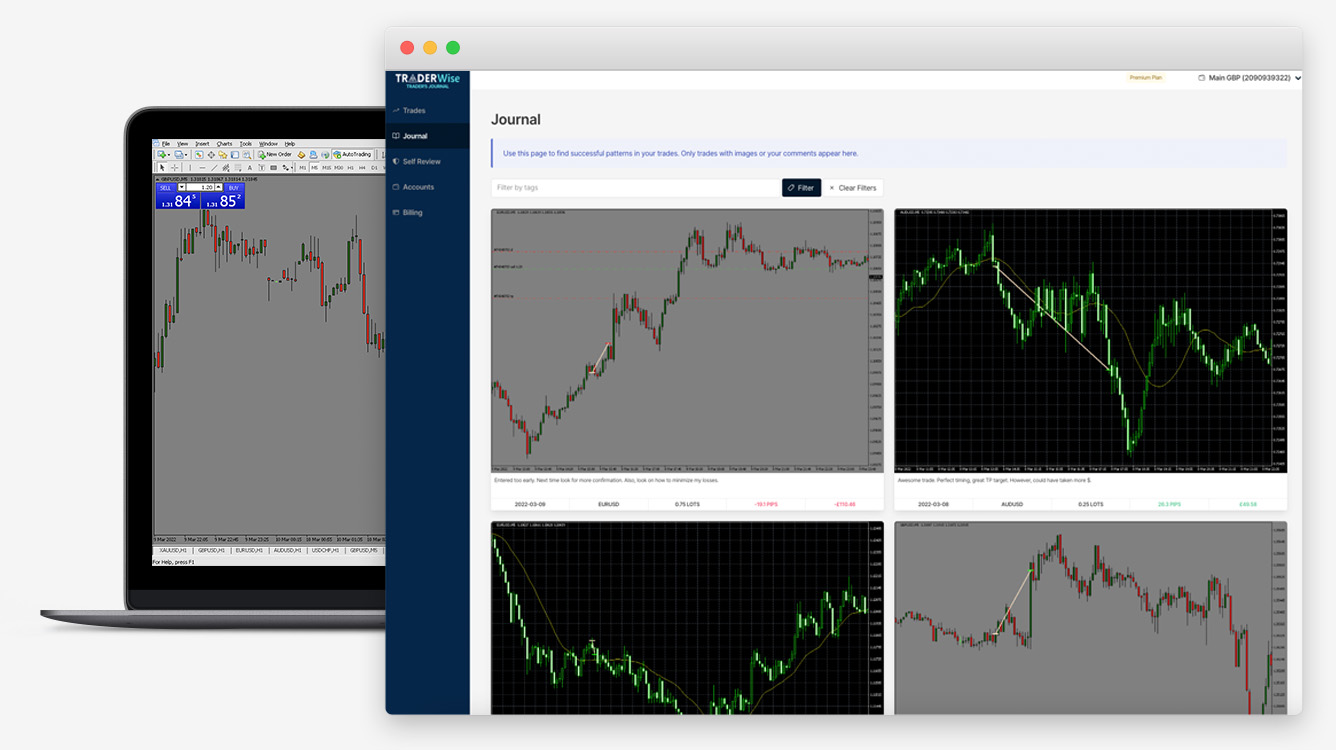

Trader's Journal

Whether you are just starting or day-trading for a living, keeping a trading journal is a must to track your performance and learn from the past trades.

Learn more 🧐 Get your free accountYou will be set up in less than 5 minutes.

Integrates with

All assets supported

Pages

Contact

Disclaimer: The information on this site is just a very basic understanding of price action Forex trading and is for entertainment value only. How I trade is very different to what you may read here. The information on this site is not a recommendation to trade Forex as I do not know your level of trading experience or your financial situation. I am not a financial advisor, and I am not qualified to give financial advice. Trading Forex profitably is a skill that cannot be learned from reading the posts on this site, and I cannot be held responsible for any trades that you may take as a result of the information on this site. So if you are trading, you are trading at your own risk, so please trade responsibly, and do not trade with money you cannot afford to lose. For help and advice please contact me, or for more information about what I do check out my Forex Trading Course.